News

Polaris Bank Inherited Liability: A Guarantor Nightmare for a Staff Loan gotten under Defunct Skye Bank

Defunct Skye Bank presently owned by Polaris Bank has suffered an innocent guarantor Mr. Ude under the watchful eyes of the current management.

In 2015, Mr. Ude was a Staff of the defunct Skye Bank and worked with a colleague called Mr. Jacobs Adeyinka Alexander in the department of Information and Technology Broad Street Branch. In his interview with onspotnewsng he revealed that he and a female colleague guaranteed Mr. Jacobs for a staff loan facility in the sum of about N2,205,000.00 in November 2015.

Not too long after the loan was collected by Mr Jacobs, he resigned from the bank by tendering his resignation letter, it was accepted by the bank HCM and the guarantors were not informed about this. Upon default of payments after resignation, Mr. Jacobs Adeyinka Alexander came for a loan restructuring at the bank and what was agreed wasn’t discussed with the guarantors again.

It was when Mr. Jacobs failed to fulfil his payment obligation after the loan was restructured that the guarantors were contacted. Mr. Ude explained to onspotnewsng that all efforts to contact Mr. Jacobs proved abortive as his rude response was that he has an understanding with the bank team, hence, the running restructed loan. Further enquiries reveal that one Mr. Tunji Bajowa, head of loan recovery whose office is located at Polaris Bank Ltd, Churchgate building Victoria Island and Mr. Fidelis were the bank handlers Mr. Ude was relating with in respect of this matter.

Consequently, the bank loan handlers hand twisted Mr. Ude to adopt and restructure the aforementioned loan as it had eroded his savings and pending salary/ monthly emolument. Twenty Four months repayment period, zero COT/ monthly interest, Payment to be remitted from staff savings account -1020245278, payment to be remitted quarterly and payment source to be from staff salary, were the terms enforced on Mr. Ude as a guarantor simply because he still wanted to be working in order to feed his family by not losing his job.

Mr. Ude curiosity by asking the loan handlers about the effort they have put into recovering the loan and what is the terms and conditions was misinterpreted as a threat. Arguably, this only makes one to ponder if there was a gimmicks going on in all of these. Questions like; Did the HCM did their due diligence to confirm Mr. Jacobs Adeyinka Alexander new employer after he left the bank to see how his payment will continue before accepting his resignation? Why was a restructure of the loan facility agreed without the knowledge of the guarantor’s? What effort has the bank made to recover funds from Mr. Jacobs? Why did the bank refuse to pay Mr. Ude his benefits/ emolument? Why did the bank throw another account into debit separate from the one agreed with him? What court order or authorization was gotten before throwing his account into debit? How much has Mr. Jacobs paid? Was the second guarantor aside Mr. Ude also forced to pay too?

Onspotnewsng investigation reveals that Mr. Jacobs Adeyinka Alexander left the defunct Skye Bank for Unity Bank, same banking industry, a proper follow up by the HCM/loan handlers should have help recover the facility seamlessly instead of Mr. Ude only bearing the abrupt of a Delinquent Account alone.

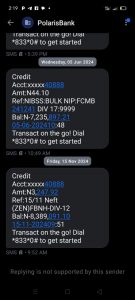

In October 2018, a negative sum of N2,511,907.18 (Two Million, Five Hundred and Eleven Thousand, Nine Hundred and Seven Naira, Eighteen Kobo) was posted to Mr. Ude staff account without recourse only to be told after probe that the unknown posted money was the staff loan granted to Mr. Jacobs Adeyinka Alexander.

As if that was not enough, March 29, 2019 the bank handed Mr Ude “a service no longer required” directive with effective date of April 1, 2019.

Despite no longer working with the Bank, Mr Ude has thrived to keep servicing the forced loan by reducing to a tune of negative N1,881,414.45 which was brought forth from the agreed serving loan account (staff saving) 1020245278 to (staff current) 1780140888. As at Close of April 2019, the forced obligation was already more than half the amount serviced, leaving the amount at Negative N1,215,324.21.

Furthermore, Mr. Jacobs loan obligation forcefully dwelling in Mr. Ude account is a negative of N8,392,339.02 with monthly debit interest capital of 248,317.13 that just accumulated and inputted on the account on the 31st Oct. 2024. What is surprising here is that how and why the figure of negative N8,392,339.02 is tagged to the account 1780140888, where the account/owner was never granted such loan and was not in the twisted inherited/ restructed staff loan of Mr. Jacobs. Again, zero interest was the forced loan on Mr. Ude, why has it grown to N8m plus?

Mr. Ude claim he has exhausted all efforts within his means to trace and locate Mr. Jacobs as his

greatly concerned for his welfare for himself and family if he continues to service a loan

facility that keeps growing coupled with economic hardship. Even most recently, one debt recovery company called “Mida Africa Ltd” contacted Mr. Ude and his response by explaining to them what really happened has fall on deaf ears.

Mr. Ude has reasonable cause to believe that Mr. Jacobs Adeyinka Alexander actions have made him to suffer innocently with the bank not giving him listening ears. Human face of handling complexities in work place and most importantly employer-employee engagement seems to be lacking in this scenario. He lost his job as a result of this forced loan and still getting frustrated over this same root cause since 2015.

A cleron call to Polaris Bank and Mr. Jacobs Adeyinka Alexander has become necessary at this juncture as all effort by Mr. Ude to have a round table discussion has proved abortive.

Business

Polaris Bank Marks World Cancer Day with Free Breast Cancer Screening for 100 Women Nationwide, Nigeria

In commemoration of World Cancer Day, slated for February 4, 2026, Polaris Bank has reaffirmed its commitment to community health and social impact with the launch of a nationwide free breast cancer screening initiative in partnership with its NGO partner, Care Organization and Public Enlightenment (C.O.P.E).

The initiative is designed to promote awareness, screening, early detection, and preventive care, reinforcing the Bank’s belief that access to health services is a critical foundation for individual and economic wellbeing.

As part of this year’s World Cancer Day activities, Polaris Bank will provide free and comprehensive breast cancer screening for 100 women across Nigeria, while also supporting an on-going free prostate cancer screening programme for 250 persons across Nigeria it earlier sponsored for men aged 40 years and above.

The prostate cancer screening is being conducted at the Men’s Clinic, situated at 18, Commercial Avenue, Sabo, Yaba, Lagos, providing accessible, professional medical support for male participants seeking early detection and preventive care for prostrate.

Both initiatives (free breast and prostate cancer screenings) directly aligns with the United Nations Sustainable Development Goals, particularly SDG 3 (Good Health and Well-being) through improved access to preventive healthcare and early detection services, SDG 5 (Gender Equality) by prioritizing women’s health and empowerment, and SDG 17 (Partnerships for the Goals) through strategic collaboration with civil society organizations such as C.O.P.E to deliver community-centered impact.

Educational materials, community engagement sessions, and digital awareness campaigns will be deployed to reinforce key messages around early detection, lifestyle choices, and the importance of regular medical check-ups.

Speaking on the initiative, Rasheed Bolarinwa, Group Head, Brand Management & Corporate Communications, Polaris Bank, emphasized that early detection remains one of the most effective tools in the fight against cancer.

By removing financial barriers and bringing screening services closer to communities, the Bank aims to empower individuals with the knowledge and resources they need to seek timely medical intervention.

The flagship breast cancer screening event will take place on Saturday, February 21, 2026, at the C.O.P.E Centre, 39B Adeniyi Jones Avenue, Ikeja, Lagos, from 10:00am to 2:00pm.

The exercise will be conducted by trained health professionals and volunteers, ensuring participants receive both screening services and educational guidance on cancer prevention, self-examination, and follow-up care.

Participation in the free breast cancer screening programme is subject to the following requirements: applicants must be women, applicants must be Polaris Bank account holders, and pre-registration is required, with selection based on early and confirmed submissions.

Eligible participants are encouraged to register via the official link: bit.ly/BCS2026.

While the breast cancer screening is targeted at women, Polaris Bank encourages men to actively support the health of their families by urging their wives, daughters, and female relatives to register and participate.

In parallel, men are also invited to take advantage of the on-going free prostate cancer screening programme for men aged 40 years and above at the Men’s Clinic, Sabo, Yaba.

Entertainment

Davido breaks silence after Grammy Award loss

Five-time Grammy nominee, David Adeleke, popularly known as Davido, has reacted after losing the Best African Music Performance category at the 68th Grammy Awards held in Los Angeles, United States.

The Afrobeats star shared a message of faith and resilience following the outcome of the ceremony, which took place on Sunday night at the Crypto.com Arena in California.

In a post on his Instagram page, Davido shared photos with his wife, Chioma, from the event and wrote, “Oluwa Dey my side,” alongside prayer and music emojis.

Hours later, he posted another set of pictures of himself and Chioma at the Grammys, reflecting on the loss in a longer caption.

“I said baby listen we lost again let’s not go ! she said ‘Be humble in victory and gracious in defeat’ we outside,” he wrote.

Chioma also reacted via her Instagram page, praising the singer, “You already know that you’re the perfect one, @davido,” she wrote, while sharing photos from the awards night.

Davido was nominated in the Best African Music Performance category at the 2026 Grammy Awards but lost to South African singer Tyla, who won with her song Push 2 Start.

Other nominees in the category included Burna Boy (Love), Ayra Starr and Wizkid (Gimme Dat), Davido (With You featuring Omah Lay), and Eddy Kenzo and Mehran Matin (Hope & Love).

The win marked Tyla’s second Grammy Award, following her first victory in 2024 for her hit single Water.

Speaking during the awards ceremony, the singer revealed that With You, featuring Omah Lay, almost did not make the final tracklist of his album 5IVE.

“Man, it’s so crazy because that song almost didn’t make the album. With You was not in anybody’s top five.

“And now look at it go. Every time I was performing it, my heart would just start beating like, what if I didn’t put this song?” he told OkayAfrica.

Davido also recounted how he learned about the Grammy nomination, saying the news came unexpectedly while he was in Dubai, days before his birthday.

“I was in the car, actually, checking a car, and then my phone rang. They were like, ‘Oh yeah, another nomination.’ I was like, wow. Thank God,” he said.

“With You” was released in April 2025 as the 17th track on Davido’s fifth studio album, 5IVE, and has since become one of his most successful recent records, surpassing 100 million streams on Spotify.

Despite the song’s success, Nigeria did not record a win at the 2026 Grammy Awards.

Davido said he is now focused on touring and releasing new music.

He is also billed to perform at Coachella 2026, where he will be the only Nigerian artiste on the festival lineup, performing on April 11 and April 18, 2026, in Indio, California.

-Guardian

Entertainment

Kunle Afolayan gives reasons to marry many women

Nollywood filmmaker, Kunle Afolayan, has stirred reactions after advising men to “marry many women” while reflecting on his upbringing in a polygamous home.

The actor and producer made the remarks at the watch party of Aníkúlápó: The Ghoul Awakens, with a clip from the event going viral on Tuesday.

Speaking at the event, Afolayan linked his existence and achievements to his late father’s decision to marry several wives.

“Without my father, there wouldn’t have been a KAP Village or even Kunle Afolayan. I am the seventh born of my father because my father had ten wives. For the men, marry many women, or rather be involved with many women. You know why? If my father didn’t, he would not have born me, and that is the honest truth. But today, a few of us are lifting his legacy. Life is short, death is constant. Nobody has life forever. Everybody has a period. Use your period,” he said.

While his daughter, Eyiyemi Afolayan, joined him on stage, the filmmaker compared his childhood experience with his relationship with his children.

“They are lucky. For her, staying by my side is luck. Do you know why? I couldn’t stand it with my father. My father didn’t know my school. My father didn’t know my date of birth. He did not know anything about me other than, ‘He is the son of that person.’ But today, I’m so proud of my father,” he added.

Afolayan also spoke about fatherhood.

“Sometimes when people say ‘Happy Father’s Day,’ I’m always saying whether he pays child support or not, he’s still a father. I have been going to court because I want to get a divorce. I don’t mind being in the witness box, and I experienced the shit, so that I can marry many wives,” he said.

He thereafter prayed for his daughter, praising her role in the series.

“Hephzibah, her mother is the one who gave her the name. I don’t care, but I am proud of you. You started with the film, you did the first season, and now with the second season, you did amazingly well. My good Lord will continue to increase you in wisdom, in knowledge, and in understanding. If this is your path, the good Lord will see you through.”

However, this is not the first time the filmmaker has spoken about his late father’s polygamous lifestyle.

In March 2021, Afolayan told BBC Pidgin that his father, Adeyemi Afolayan, who died in 1996, married 10 wives and had 25 children, a decision he said took a toll on the family.

“I would not want to marry many wives because my father had 10 wives and I knew what happened throughout that period. I knew that really distracted my father. In this age, nobody needs to tell you before you know what’s right,” he said at the time.

He also disclosed that growing up in a polygamous home affected bonding among the children due to language and other barriers.

Afolayan further narrated how he battled poverty in his early years, revealing that he once lived in a one-room apartment in Ebute-Metta and sometimes had to deal with flooding.

“I was born in Ebute-Metta and have lived in one-room apartment before that we even have to grapple with flood sometimes. It’s not shame to say have been poor before. But if you see how l made it, it’s a matter of consistency. My father was a very popular filmmaker and ordinarily, people would expect me to life the kind of live akin to Hollywood stars,” he said.

“But that wasn’t the case. How would one live such life when you’re living in a room with ten women. That doesn’t mean there was no love among us.”

He had advised young filmmakers to start with the little resources available to them while working towards their dreams.

-Guardian

-

Article10 months ago

Article10 months ago5 Life Lessons from Manchester City EPL Current woes

-

Sports10 months ago

Sports10 months agoLiverpool Announce Jürgen Klopp Return To The Club

-

Business10 months ago

Business10 months agoMTN Teams Up With Meta To Boost WhatsApp Call Quality

-

News10 months ago

News10 months agoCommonwealth Observers Prepare For Gabon Presidential Election

-

Article10 months ago

Article10 months agoPonzi Scheme CEO Francis Uju Udoms of Addfx Case still Unresolved Despite SEC certification

-

News10 months ago

News10 months agoChibok Girls: 11 Years Of Anguish, Broken Promises

-

News8 months ago

News8 months agoNASRE Promises Support To Daily Times Group Business Editor, Oseni, Over Serious Road Accident

-

News10 months ago

News10 months agoWike’s Enviable Road Construction Method along Nyanya- Maraba Highway